Brexit will not be easy

U.K. Prime Minister Theresa May needs to brace for a tough autumn as the obstacles to her Brexit planning mount.

The first challenge comes from the European Union. Bloomberg’s Birgit Jennen reports how the bloc’s deputy Brexit negotiator, Sabine Weyand, this week told German lawmakers she’s skeptical the two sides will be able to start crafting a trade deal in October as initially hoped. Her boss, Michel Barnier, will on Wednesday brief ambassadors from the 27 EU member states in Brussels.

Back in London the opposition Labour Party is seeking to block May’s blueprint for a post-Brexit legal regime. Without a majority in Parliament, May is also vulnerable to rebels from her own Conservative side.

As the government tries to transfer 12,422 pieces of EU law on to the British statute book, Labour is challenging a proposal to allow ministers to revise some of the rules without full parliamentary scrutiny. Some Tories, including former Attorney General Dominic Grieve, have also expressed reservations about that.

If Parliamentary approval is required for each regulation, they risk being held up by constant roadblocks.

“Nobody has ever promised this will be simple or easy,” U.K. Brexit Secretary David Davis told Parliament on Tuesday, drawing laughter from lawmakers who remember that many of those who backed Leave made the same argument.

Davis predicted spats with the EU over Britain’s exit bill alone could last until 2019 and also suggested the EU would be the bigger loser if there was no deal. “There will be times when it is very stormy,” he said.

As if that’s not enough, May also has to contend with a leak of a draft plan for new immigration rules, which would end the free movement of workers on the day Britain leaves the EU and impose restrictions on all but highly skilled workers from the region. The 82-page document, obtained by the Guardian, said immigration should not just benefit the migrants but “make existing residents better off.”

— by Simon Kennedy

Brexit Latest

Science Paper | The government said it wanted to continue close collaboration with the EU in science and innovation after Brexit. A new “position paper,” which will form the basis for future negotiations in Brussels, will be published Wednesday, setting out Britain’s long-term vision for science, including space exploration and nuclear research.

Drug Problem | AstraZeneca Chief Executive Officer Pascal Soriot said he’s worried about the lack of progress over a future trade accord, which could impede sales of drugs in foreign markets. “So far, we don’t have any idea how products will be shipped across borders,” he said in an interview.

Swiss U-Turn | Swiss asset manager GAM is in talks to lease a new U.K. headquarters in London more than a year after it cancelled an agreement to switch offices in the capital because of Brexit.

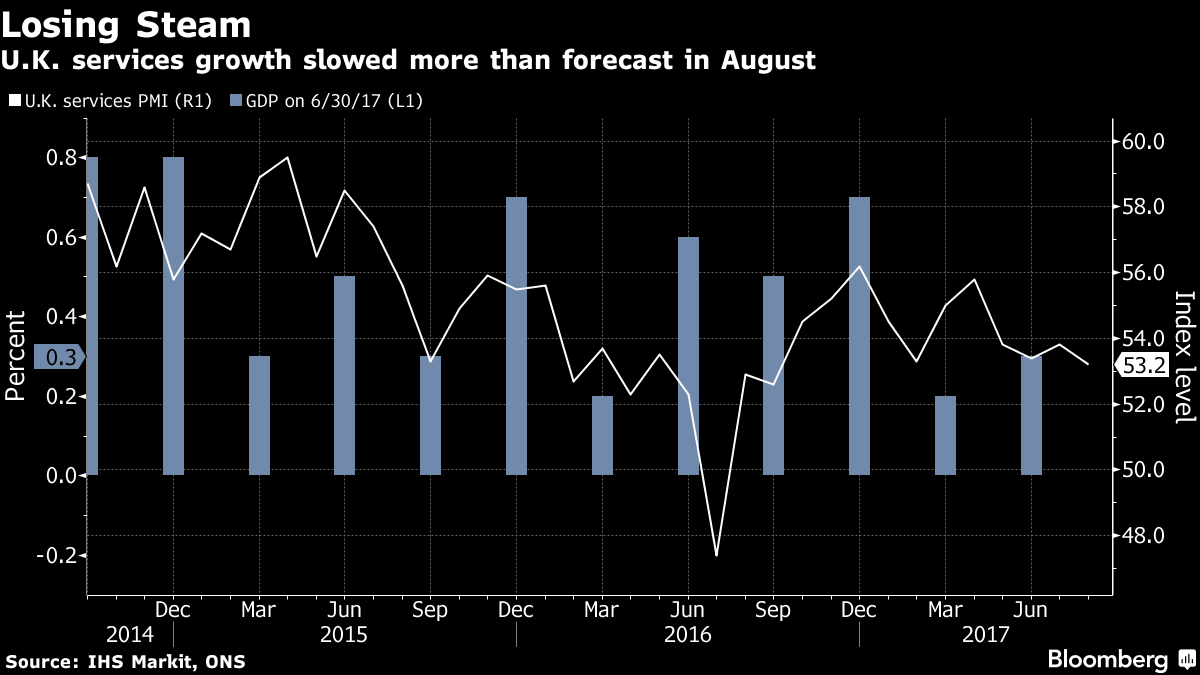

Weak Growth | Britain’s economy is failing to recharge after slowing sharply in the first half of the year. IHS Markit said its latest round of industry surveys suggest growth of about 0.3 percent this quarter, matching the pace of the previous three months. It published the forecast after its gauge of the services sector, the biggest part of the economy, indicated the slowest expansion in almost a year in August.

A Bigger Threat | The EU risks losing its allure and ultimately falling apart if it pursues plans to integrate member nations at different speeds, Polish President Andrzej Duda said. While the EU is preoccupied with the U.K.’s exit, its biggest problem would be leaving some countries behind in a “B-class,” he said.

Research Wrap | Andrew Duff of the European Policy Centre writes how May’s forthcoming speech on Brexit will be her “last chance to repair the damage” he says has occurred. In a report for The U.K. in a Changing Europe, academics Katy Hayward and David Phinnemore say Britain needs to do more to recognize the “unique needs” of the Irish in the talks. Mujtaba Rahman of the Eurasia Group says the U.K. will need to pay “for past obligations, not just future access to the single market.”

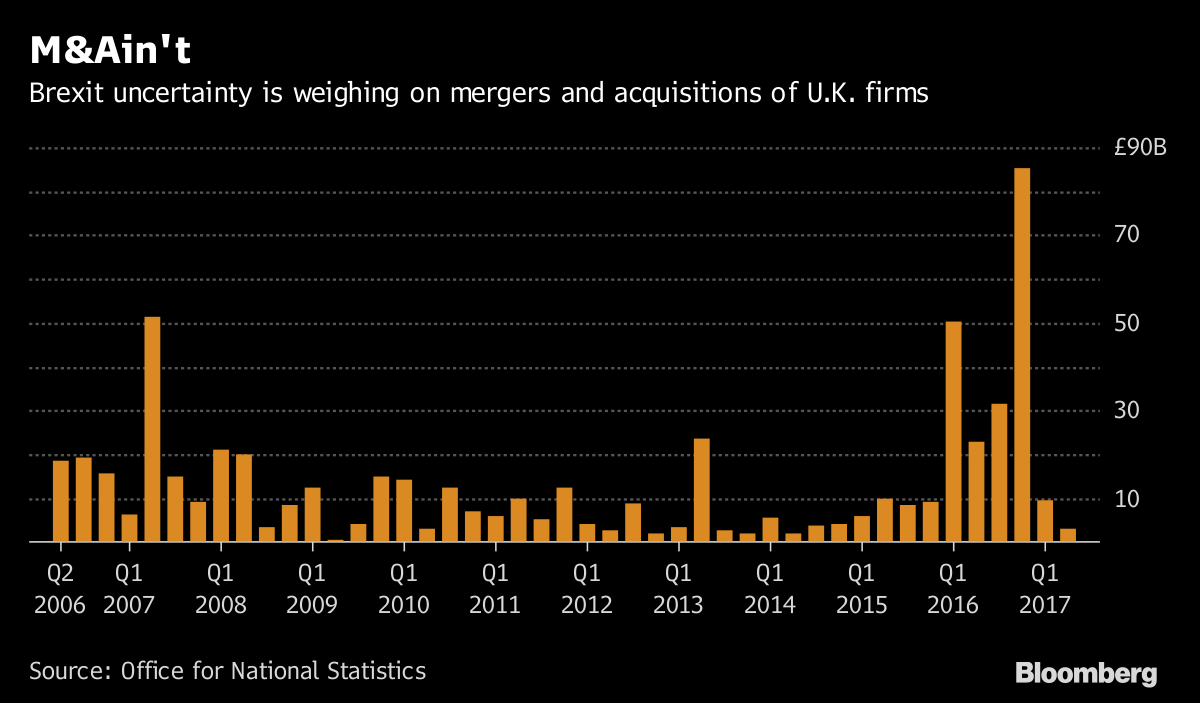

On the Markets | The cheap pound is doing little to boost the appeal of British assets. There were 44 foreign acquisitions of U.K. companies in the second quarter, the fewest in almost two years, according to figures from the statistics office. The value of such deals fell to £2.9 billion pounds and was outstripped by disposals for the first time since 2002.

Comentarios

Publicar un comentario